How Does Buying Mortgage Points Work . Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. how do mortgage points work? Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. mortgage points, often called discount points, are a way for home buyers to pay to lower the interest rate on their home loan. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Points are considered prepaid interest, and. There are two kinds of mortgage points: mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. Origination points and discount points. Learn how much they cost, how they work, and when they are worth it. Buyers pay origination points to the lender as a type of fee for processing the loan. mortgage points work by lowering the interest rate on a home loan.

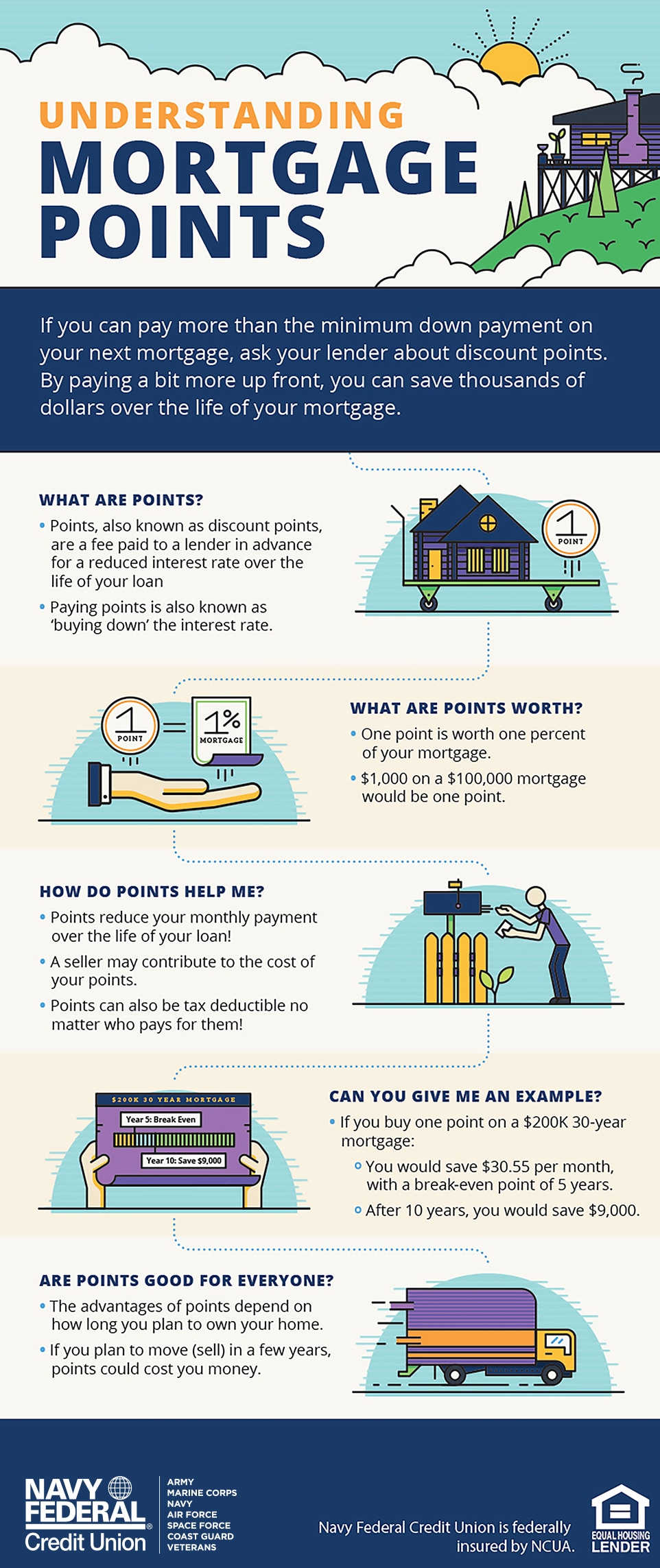

from www.navyfederal.org

There are two kinds of mortgage points: Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. Origination points and discount points. how do mortgage points work? mortgage points work by lowering the interest rate on a home loan. Learn how much they cost, how they work, and when they are worth it. Points are considered prepaid interest, and. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Buyers pay origination points to the lender as a type of fee for processing the loan. mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan.

How Do Mortgage Points Work? Navy Federal Credit Union

How Does Buying Mortgage Points Work mortgage points are an upfront fee that lowers your interest rate and monthly payments. Points are considered prepaid interest, and. Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. mortgage points are an upfront fee that lowers your interest rate and monthly payments. mortgage points, often called discount points, are a way for home buyers to pay to lower the interest rate on their home loan. Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. mortgage points work by lowering the interest rate on a home loan. Learn how much they cost, how they work, and when they are worth it. how do mortgage points work? Origination points and discount points. There are two kinds of mortgage points: Buyers pay origination points to the lender as a type of fee for processing the loan.

From exojmnmor.blob.core.windows.net

Mortgage Calculator With Points And Closing Costs at Donna Burkholder blog How Does Buying Mortgage Points Work mortgage points work by lowering the interest rate on a home loan. Learn how much they cost, how they work, and when they are worth it. Points are considered prepaid interest, and. Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. how do mortgage points work? Each mortgage point. How Does Buying Mortgage Points Work.

From newsilver.com

What Are Mortgage Points? Detailed Guide New Silver Lending How Does Buying Mortgage Points Work Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. There are two kinds of mortgage points: Points are considered prepaid interest, and. mortgage points work by lowering the interest rate on a home loan. Learn how much they cost, how they work, and when they are worth it. mortgage. How Does Buying Mortgage Points Work.

From www.ramseysolutions.com

What Are Mortgage Points and How Do They Work? Ramsey How Does Buying Mortgage Points Work mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Each mortgage. How Does Buying Mortgage Points Work.

From www.pinterest.com

Buying a HouseWhat are (discount) points and lender credits and how do How Does Buying Mortgage Points Work Buyers pay origination points to the lender as a type of fee for processing the loan. Origination points and discount points. Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. Points are considered prepaid interest, and. There are two kinds of mortgage points: mortgage points are an upfront fee that. How Does Buying Mortgage Points Work.

From www.usbank.com

What are mortgage points and how do they work? U.S. Bank How Does Buying Mortgage Points Work There are two kinds of mortgage points: Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. Origination points and discount points. Points are considered prepaid interest, and. mortgage points, often called discount points, are a way for home buyers to pay to lower the interest rate on their home loan.. How Does Buying Mortgage Points Work.

From casaplorer.com

Mortgage Points Calculator 2022 Complete Guide Casaplorer How Does Buying Mortgage Points Work mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Origination points. How Does Buying Mortgage Points Work.

From belavorahomes.com

What are mortgage points and how do they work? Realtor in Philly How Does Buying Mortgage Points Work There are two kinds of mortgage points: Points are considered prepaid interest, and. how do mortgage points work? mortgage points are an upfront fee that lowers your interest rate and monthly payments. Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. mortgage points, often called discount points, are. How Does Buying Mortgage Points Work.

From mortgagearchitects.us

What Is a Mortgage Discount Point? Exploring the Basics and Benefits How Does Buying Mortgage Points Work mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. There are two kinds of mortgage points: Buyers pay origination points to the lender as a type of fee for processing the loan. how do mortgage points work? mortgage points, often called discount. How Does Buying Mortgage Points Work.

From www.consumerscu.org

How Do Mortgage Points Work? Consumers Credit Union How Does Buying Mortgage Points Work Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. There are two kinds of mortgage points: Learn how much they cost, how they work, and when. How Does Buying Mortgage Points Work.

From www.navyfederal.org

How Do Mortgage Points Work? Navy Federal Credit Union How Does Buying Mortgage Points Work how do mortgage points work? mortgage points, often called discount points, are a way for home buyers to pay to lower the interest rate on their home loan. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Mortgage points shave off fractions of a percent from your rate, which can save you. How Does Buying Mortgage Points Work.

From www.brentthebroker.com

How Mortgage Points Work Brent The Broker How Does Buying Mortgage Points Work Points are considered prepaid interest, and. mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. There are two kinds of mortgage points: mortgage points work by lowering the interest rate on a home loan. Each mortgage point costs 1% of your mortgage amount. How Does Buying Mortgage Points Work.

From homebuyinginstitute.com

Mortgage Loan Approval Process Explained The 6 Steps to Closing How Does Buying Mortgage Points Work There are two kinds of mortgage points: Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. Buyers pay origination points to the lender as a type of fee for processing the loan. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Origination points and discount. How Does Buying Mortgage Points Work.

From www.biggerinvesting.com

All About Mortgages What are Points on a Mortgage? How Does Buying Mortgage Points Work There are two kinds of mortgage points: Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. Origination points and discount points. Points are considered prepaid interest, and. mortgage points are an upfront fee that lowers your interest rate and monthly payments. Buyers pay origination points to the lender as a. How Does Buying Mortgage Points Work.

From aspenpremierproperties.com

Mortgage Points, Explained Real Estate in Aspen, CO Homes for Sale How Does Buying Mortgage Points Work how do mortgage points work? mortgage points work by lowering the interest rate on a home loan. mortgage points, often called discount points, are a way for home buyers to pay to lower the interest rate on their home loan. Points are considered prepaid interest, and. Learn how much they cost, how they work, and when they. How Does Buying Mortgage Points Work.

From www.wesellthewest.com

What Are Mortgage Points and How Do They Work? Western Land How Does Buying Mortgage Points Work mortgage points are an upfront fee that lowers your interest rate and monthly payments. mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. There are two kinds of mortgage points: mortgage points work by lowering the interest rate on a home loan.. How Does Buying Mortgage Points Work.

From woodgroupmortgage.com

Mortgage Points What They Are, How They Work, & More How Does Buying Mortgage Points Work Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. There are two kinds of mortgage points: Buyers pay origination points to the lender as a type of fee for processing the loan. Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. . How Does Buying Mortgage Points Work.

From www.homeownershiphub.com

Mortgage Points How They Impact Interest Rates and Payments How Does Buying Mortgage Points Work There are two kinds of mortgage points: Mortgage points shave off fractions of a percent from your rate, which can save you thousands of dollars. mortgage points, often called discount points, are a way for home buyers to pay to lower the interest rate on their home loan. mortgage points are an upfront fee that lowers your interest. How Does Buying Mortgage Points Work.

From www.apmortgage.com

Closing Costs Mortgage Points Explained How Does Buying Mortgage Points Work Origination points and discount points. mortgage points, also called discount points, are fees that borrowers can pay upfront in exchange for a lower interest rate on their home loan. Each mortgage point costs 1% of your mortgage amount and will lower your interest rate by approximately 0.25%. Learn how much they cost, how they work, and when they are. How Does Buying Mortgage Points Work.